AI customer churn prediction is a powerful tool that uses machine learning algorithms to anticipate and prevent customer departure, vital for business growth and sustainability. By analyzing historical data like purchase patterns and usage trends, these models identify subtle signals of potential churn, allowing businesses to implement retention strategies proactively. This minimizes revenue loss, enhances customer satisfaction, and enables continuous adaptation to evolving market conditions. In addition, AI-driven fraud detection leverages vast datasets for accurate predictions, enhancing security in a digital landscape. Implementing AI customer churn prediction models is a strategic approach to boost fraud prevention and customer retention through personalized interactions, ultimately increasing satisfaction and loyalty.

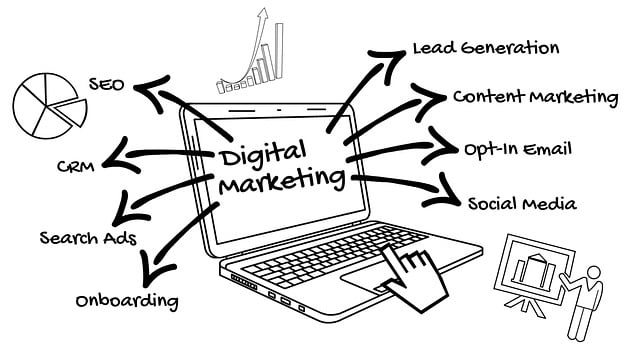

In today’s digital landscape, AI business fraud detection platforms are transforming the way enterprises safeguard their operations. By leveraging advanced analytics and machine learning algorithms, these platforms predict and prevent fraudulent activities with unprecedented accuracy. Understanding AI customer churn prediction is key to unlocking the potential of these tools. This article explores how AI fraud detection systems utilize sophisticated analytics for robust business protection, alongside practical strategies for implementing AI-driven solutions to enhance fraud prevention and customer retention.

- Understanding AI Customer Churn Prediction: The Power of Machine Learning Algorithms

- How AI Fraud Detection Platforms Utilize Advanced Analytics for Business Protection

- Implementing AI-Driven Solutions: Strategies to Enhance Fraud Prevention and Customer Retention

Understanding AI Customer Churn Prediction: The Power of Machine Learning Algorithms

AI Customer Churn Prediction leverages machine learning algorithms to anticipate and prevent customer departure, a critical aspect of business growth and sustainability. These algorithms analyze vast amounts of historical data – purchase patterns, interaction frequency, usage trends – to identify subtle signals indicating potential churn. By understanding the factors that contribute to customer dissatisfaction or loss, businesses can proactively implement retention strategies. This not only minimizes revenue loss but also enhances customer satisfaction by addressing issues before they lead to churn.

The power of AI customer churn prediction lies in its ability to adapt and learn continuously. Machine learning models evolve as new data becomes available, allowing them to capture emerging trends and patterns. This dynamic nature ensures that retention strategies remain relevant and effective, even as market conditions and customer preferences shift. As businesses increasingly rely on subscription models and digital interactions, AI customer churn prediction emerges as a vital tool for maintaining competitive edge and fostering long-term customer relationships.

How AI Fraud Detection Platforms Utilize Advanced Analytics for Business Protection

Advanced analytics is revolutionizing business fraud detection, and AI platforms are at the forefront of this transformation. These intelligent systems leverage machine learning algorithms to analyze vast datasets, identifying intricate patterns and anomalies indicative of fraudulent activities. By processing historical data, transaction records, and customer behavior insights, AI can predict potential risks with remarkable accuracy. For instance, AI customer churn prediction models not only identify high-risk customers but also provide actionable insights to mitigate losses.

The power of AI lies in its ability to adapt and learn continuously. It can detect unusual spending patterns, unexpected account activity, or deviations from typical customer behavior. This real-time monitoring enables businesses to take proactive measures against fraudsters, enhancing overall security and protection for sensitive transactions. With such sophisticated analytics, organizations can stay ahead of evolving fraudulent schemes, ensuring the integrity of their operations in an increasingly digital landscape.

Implementing AI-Driven Solutions: Strategies to Enhance Fraud Prevention and Customer Retention

Implementing AI-driven solutions is a strategic move for businesses aiming to enhance fraud prevention and boost customer retention. By leveraging machine learning algorithms, platforms can analyze vast amounts of data to identify patterns indicative of fraudulent activities more accurately than traditional methods. This proactive approach enables businesses to detect anomalies early, mitigate risks, and protect their customers’ interests.

AI customer churn prediction models, for instance, can identify at-risk customers by forecasting potential departures based on historical behavior and transaction data. Proactive engagement with these customers not only reduces fraud losses but also fosters stronger customer relationships. Through personalized interactions and tailored solutions, businesses can address underlying issues driving churn, ultimately increasing customer satisfaction and loyalty.

AI fraud detection platforms, powered by advanced analytics and machine learning algorithms, offer businesses an innovative approach to combat fraudulent activities and enhance customer retention. By understanding AI customer churn prediction, implementing strategic solutions, and leveraging these cutting-edge technologies, companies can navigate the complex landscape of fraud prevention with greater efficiency and accuracy. This not only safeguards their operations but also fosters a stronger, more loyal customer base.